You’ve likely seen the “gridlock,” “polarization” and “stalemate” headlines to describe what the state of affairs will likely be in Washington, D.C., over the next two years of divided government. As an American, it can feel deflating, no matter which party you ascribe to.

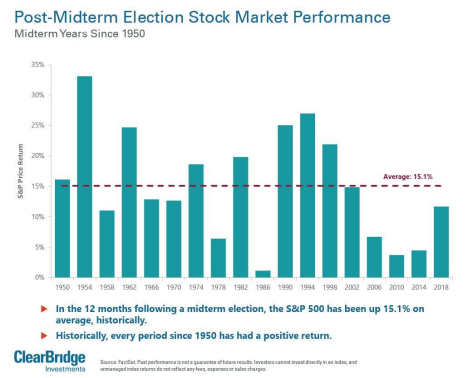

However, what’s often left out of these stories is that stocks have a long history of performing positively under a split Congress, as well as in the months following a midterm election. In the November 2022 midterm election, Republicans won the House and the Democrats held on to the Senate. This newly divided Congress convened for the first time in January 2023.

Let’s take a look at how the stock market has historically performed during times of divided government like these:

- Since 1948, the average annual return for the Dow Jones Industrial Average was +8.3% versus +12.9% when Congress was split

- When the U.S. has had a divided government, one-year returns have been positive 70% of the time

- During the six months following a midterm election, the S&P 500 has posted positive results 100% of the time

As always, investors should be aware that while the past doesn’t predict what will happen in the future, the above patterns are worth taking into account. This is especially true since divided government is no longer a rare event; it has become the norm since World World II.

Split congress = stability

But why does the market favor a divided government, which makes it harder to enact legislation?

"If it's divided, then you get more stability and more assurances that it's not going to go in any extreme way,” said Itay Goldstein, a professor of finance and economics at the University of Pennsylvania's Wharton School of Business.

With Democrats and Republicans not being able to agree on a wide range of issues, only legislation with bipartisan support can advance. And there are only a handful of those bills, so the status quo stands.

Historically, this has meant no changes to the tax code, no heavy spending bills and no major regulation when Congress is split. This provides investors with a higher sense of certainty of what lies ahead, which the market prizes.

"Markets don’t react well to uncertainty so political gridlock is normally a favorable outcome as new measures from the administration are thwarted by the opposing party," said George Smith, portfolio strategist at LPL Financial.

Indeed, stocks have had a strong start to the first month of 2023’s divided government, with the Nasdaq having its best January since 2001.

But one area where the market would not react well to a divided government stalemate is around raising the debt ceiling, which is necessary for the Treasury to continue issuing debt to fund the government. In the past, markets have reacted negatively when it looks like a debt default is possible. However, chief financial officers continue to see the current debt ceiling debate and risk of default as a low-risk probability.

The fundamentals matter most

Despite the above historical correlation between midterm elections and positive equity performance, at Van Leeuwen & Company, we believe what will drive the performance of 2023’s stock market the most are the fundamentals: inflation, interest rates, corporate earnings and Federal Reserve policy.

Just over a month into 2023, investors have seen some positive signs with inflation moderating, smaller interest rate hikes and few signs of a recession. But January 2023’s jobs report, which detailed an

unexpectedly strong labor market that could feed inflation, might cause the Federal Reserve to change course and raise rates more.

Given investors ultimately don’t know what 2023 will bring in terms of stock market performance, we always advise our corporate executive clients to stick to their well-built, customized financial plans that take a long view. Markets reward investors who stay the course. If we can help you chart your unique course, please get in touch.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.